Change Points - Multivariate

Intended audience: END-USERS DATA SCIENCE DEVELOPERS

AO Easy Answers: 4.3

Overview

The Multivariate Change Point Detection generates one Individual Change Point Insight for the Time Durations selected for each time series.

Purpose

The purpose of Change Point Detection is to identify moments in time where a significant shift occurs in the behavior of a time series, allowing financial institutions to recognize critical changes in trends, patterns, or volatility in stock prices and market indices.

Business Example

Stock brokerage firms need to quickly identify any significant changes in stock price behavior or market trends to adjust their strategies and provide timely advice to clients. By detecting these change points, firms can help their clients navigate market uncertainties more effectively.

Scenario

Imagine a stock brokerage company monitoring Nvidia’s stock price along with broader market indices such as the S&P 500 and NASDAQ. Suppose that Nvidia's stock price was stable at $100.1 between December 27th and December 30th, 2018, while the S&P 500 and NASDAQ indices showed consistent trends. However, suddenly, Nvidia’s stock price drops to $95 on December 31st while the market indices remain steady.

The brokerage firm uses Change Point Detection to identify this abrupt change in Nvidia's stock price as a critical moment that could signal a shift in the stock's future behavior. This change point might indicate the start of a new trend, a response to external market factors, or an anomaly that requires further investigation.

Results

By identifying the change point on December 31st, the brokerage firm can quickly respond to this shift by re-evaluating their investment recommendations for Nvidia. This might involve advising clients to sell, hold, or monitor the stock more closely depending on further analysis of the cause and potential impact of the change. Recognizing and responding to change points enables the firm to mitigate risks, capitalize on emerging opportunities, and enhance their overall service to clients.

Change Point Detection thus empowers the brokerage firm to act swiftly when unexpected changes occur, helping clients protect their investments and adapt to new market conditions. This capability strengthens the firm's ability to provide proactive and informed financial advice, leading to better outcomes for both the firm and its clients.

Data Sample

Date | Nvidia | Sp 500 |

12/27/2018 | 100.1 | 7,489.86 |

12/28/2018 | 100.1 | 7,489.86 |

12/29/2018 | 100.1 | 7,489.86 |

12/30/2018 | 100.1 | 7,489.86 |

12/31/2018 | 100.1 | 7,489.86 |

01/13/2019 | 189.45 | 13,115.68 |

01/14/2019 | 189.45 | 13,115.68 |

01/15/2019 | 189.45 | 13,115.68 |

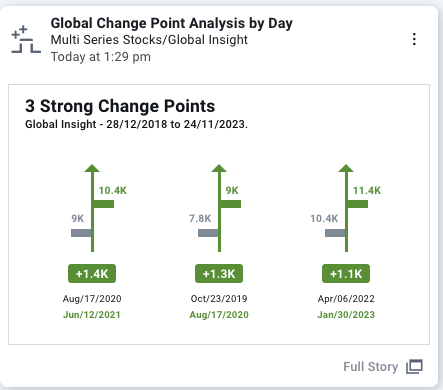

Infographics Insight

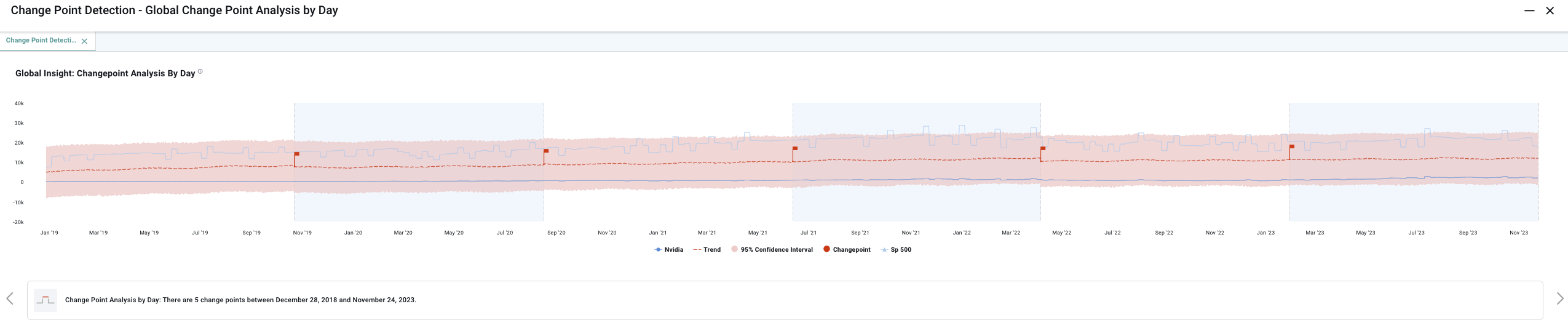

Full Story Insight

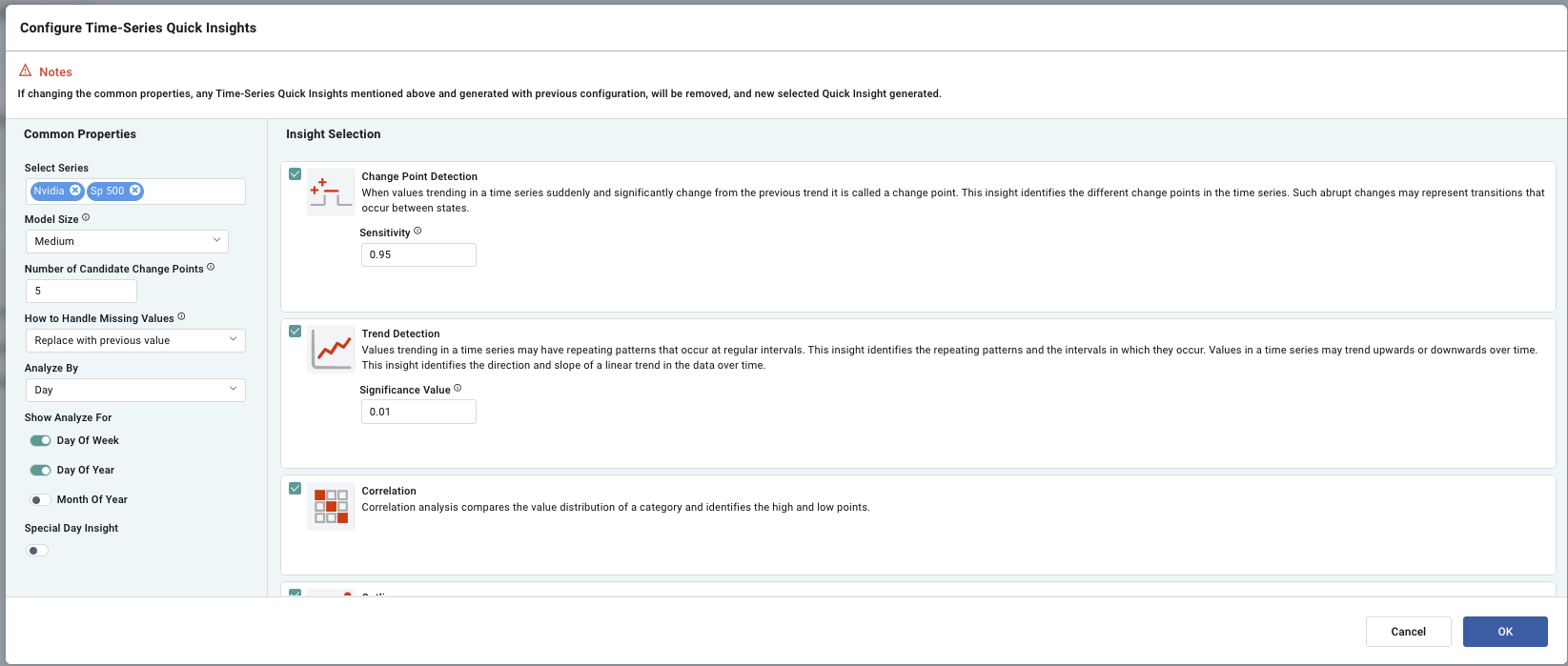

End User Configuration - using Easy Answers solution